Consultants with Baker Tilly presented a financial analysis of proposed annexation at the Monroe County Council on July 27. The report was commissioned by the county to independently assess the financial impact of Bloomington's annexation. The report noted some variances between the Baker Tilly analysis and the City of Bloomington's fiscal plan, which is posted on the city's annexation website. Some of those variances are due to different approaches taken in calculating the impact. For example, the city used 2019 assessment data, while the Baker Tilly consultants used data from 2020. Read the report here. Watch the Baker Tilly presentation on CATS here. An "impact calculator" is available on the county's website. The county has scheduled three public forums to discuss the Baker Tilly report:

The Bloomington Council will hold a public hearing on annexation at their Aug. 4 meeting starting at 3 p.m. The council is expected to vote on Sept. 15. More about the city's annexation process here.

0 Comments

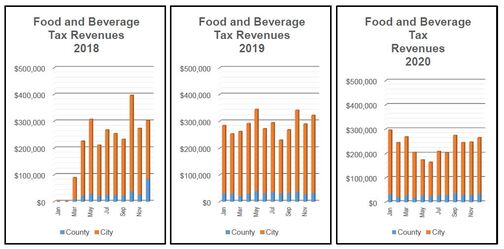

Jeff Ryan of Real America Jeff Ryan of Real America At their June 16 meeting, Bloomington City Council unanimously approved a 10-year abatement for the Retreat at Switchyard, a residential development at 1730 S. Walnut St. The development involves construction of 64 residential units. Of those, 48 units will be devoted to households with low to moderate-incomes for a period of 99 years. Ten of those 48 apartments are set aside for clients of StoneBelt. The five-story building, adjacent to the Switchyard Park east entrance, includes a 3,000-square-foot first-floor retail space. The abatement, which is applicable only to the 48 affordable units, would start at 100% and step down to 5% in year 10. The developer is Real America. The city's Redevelopment Commission intends to convey the land and structure to Real America for $1. That's a value of about $975,000, according to Alex Crowley, director of the city's Economic & Sustainable Development department. Watch the council's June 16 deliberations on CATS here. Read abatement-related materials from the council's meeting packet here.  Local Food & Beverage Tax revenues dropped 19% in 2020, according to a recently released annual report. The 1% tax has been collected countywide since 2018. In 2020, nearly $2.8 million was collected, a drop of about $650,000 compared to 2019. Read the full report here.  During a 5-hour meeting on Sept. 16, the Bloomington City Council voted down an 0.25% local income tax increase proposed by Mayor John Hamilton. The vote on the 9-member council was four in favor, five opposed. Voting against the proposal were Isabel Piedmont-Smith, Susan Sandberg, Sue Sgambelluri, Jim Sims and Ron Smith. The Chamber also had opposed the increase, and CEO Erin Predmore spoke against it in the public commentary portion of Wednesday's meeting. “A lack of public process makes this tax proposal impossible to support,” she said. The Chamber looks forward to working with City of Bloomington and Monroe County decision-makers, as well as state legislators and the public, to collaboratively address our community's challenges together in the coming months.  Erin Predmore Erin Predmore The Greater Bloomington Chamber of Commerce is urging the Bloomington Common Council to vote against Mayor John Hamilton’s proposal to increase the local income tax (LIT) by 0.25%. “A lack of public process makes this tax proposal impossible to support,” said Erin Predmore, the Chamber’s President & CEO. “Adding to the community’s tax burden is an important decision and should be guided by a clear community consensus. That work hasn’t happened.” In an online survey of Chamber members taken this week, 73% of respondents opposed the current proposal and an additional 18% opposed it at this time. Only 9% supported the proposal. The Chamber’s concerns about the proposed tax increase include: Lack of public engagement. The mayor proposed this tax increase in mid-July, but there was no subsequent attempt at public engagement until recently. The proposal was not mentioned during the August budget presentations, when it would have been an obvious and relevant point of discussion. Feedback from the community should be incorporated at the start of the process as a way to determine whether a tax is needed and how much is needed, not after a tax increase has been implemented. Lack of a compelling, sustainable plan. The current proposal is a grab bag of projects, including park trails, a composting program, a new transportation demand management job and more. The projects add to the city’s financial burden while lacking a coherent vision for how the LIT investments will be sustained. Before imposing a tax increase – especially one designed to spur economic development – the city needs to ensure a measurable return on investment and a long-term plan for supporting these investments. It is irresponsible to continue a cycle of taking property off the tax rolls, raising taxes and adding to the city’s financial commitments. Lack of collaboration. This proposal harms much-needed collaboration between the city and county, and with state legislators. The Monroe County Council has issued a statement urging the city to postpone this proposal, and we agree. Ignoring county officials risks damaging the important city-county relationship, which is already frayed. Further, city officials need to build stronger relationships with state legislators. Speculation about possible actions during the next legislative session is being used to justify pushing through this tax increase. The Chamber urges leaders of the City of Bloomington to strengthen intergovernmental relationships for the benefit of our community. There’s precedent for a different approach. In 2016, a LIT increase for public safety was passed with broad support for a focused purpose. The current proposal does not reflect that kind of community buy-in. “Businesses and individuals are stressed from the COVID-19 pandemic and face an uncertain future,” Predmore said. “Without a thoughtful, collaborative process and a sustainable plan, we can not support this tax increase and we urge Bloomington councilmembers to vote against it.”  At its Sept. 8 meeting, the Monroe County Council unanimously approved a statement that urges the Bloomington Common Council to postpone a vote on a proposed 0.25% increase to the local income tax. The Bloomington Council is on track to vote on the proposal on Sept. 16 and will hold a meeting on Sept. 9 to discuss it. The statement is written as a letter to Bloomington Council and reads, in part: With the health and welfare of our residents in mind, we, respectfully, ask the Common Council to: 1. Slow the process down. Let us, please, take time to plan and take seriously the fiscal obligations we owe to all Monroe County Residents. There may be a time in the future when a tax increase is needed and the right action to take, but now is not that time. There is no need to fast‐track this legislation. 2. Jointly advocate, with the County, for legislative reform that allows both units to raise revenue, with appropriate input from residents in a way that recognizes the difference in needs and representation among the units. Click here to read the full statement. Click here to watch the County Council's discussion on Sept. 8. Click here to read more background about the tax proposal.  In a speech on Thursday called "Recovering Forward," Bloomington Mayor John Hamilton proposed a raft of spending initiatives aimed at boosting the local economy in the wake of the COVID-19 pandemic, including a new 0.25% local income tax. From his speech: "I know it is rarely popular to raise revenues, and that it is not easy during times of economic pressure. But we cannot Recover Forward without it. Without it, we will shortchange our future and Bloomington’s potential. And, being one of the lowest-tax cities in a low-tax state in one of the lowest-tax countries, we have fiscal room to do so. Recover Forward lets us dedicate these resources toward those most in need, and toward the Bloomington we want to become." Click here for a transcript. A video of his speech is available at the bottom of that page. In January, the mayor proposed an 0.5% local income tax for sustainability initiatives, but that proposal was abandoned when the pandemic hit. The mayor does not have the authority to enact a local income tax (LIT). It would need to be approved by the elected fiscal authorities in Monroe County, including the Bloomington City Council and Monroe County Council, in weighted votes based on the proportion of the population that elected officials of each entity represents. Because Bloomington is the largest population base, an eight-vote majority of the Bloomington City Council could pass a LIT for the entire county. About half of the proceeds would go to the county government.  Monroe County is accepting applications from locally-owned businesses located outside the City of Bloomington that need support in the wake of the COVID-19 pandemic. Click here for the application. The county has allocated $200,000 from its share of Food & Beverage Tax revenues for this purpose. The 3-page application was posted on Thursday, March 26. An introductory section states: "Completing the application does not guarantee that funding will be made available. The scope of funding will be reviewed weekly by the Board of Commissioners. In addition to restaurants and bars, other locally-owned businesses that support tourism are encouraged to complete the survey if they have been impacted by the COVID-19 pandemic. The Board of Commissioners recognize that while there are some long-term funding opportunities for businesses, short-term assistance may be vital for the survival of our local economy." The City of Bloomington is in the process of allocating up to $2 million of its Food & Beverage Tax revenues for a similar purpose, but has not yet developed an application process to receive those funds.  Panelists in the WFIU studio. Panelists in the WFIU studio. A lively discussion on the proposed local income tax increase was the focus of the March 6 WFIU Noon Edition. Panelists included Mary Morgan, the Chamber's Director of Advocacy & Public Policy; Bloomington Mayor John Hamilton; Bloomington City Councilmember Matt Flaherty; and Ellettsville Town Councilmember William Ellis. Click here to listen. The panel was moderated by WFIU's Bob Zaltsberg and Sara Wittmeyer, who also took questions from listeners calling in or emailing. The Chamber has not yet taken a position on the income tax proposal, as few details have been provided about how the money would be spent in the proposed Sustainability Investment Fund. We continue to advocate for transparency and accountability in all aspects of government, as well as for broad public engagement in decision-making.  The City of Bloomington is hosting a forum on Thursday, March 5 to discuss priorities for a new Sustainability Investment Fund and a possible increase in the local income tax to support the fund. The event runs from 7 to 9 p.m. at The Mill, 642 North Madison St. According to a city press release, the format will include a brief presentation, followed by opportunities to discuss topics with subject-matter experts. Those topics include the city's "comprehensive response to climate change, how the fund might support social equity, and the possibilities the fund could create in areas from transit and other mobility options to sustainable housing and green infrastructure, among others." A light meal will be provided. The city is also asking residents to share comments and suggestions about the Sustainability Investment Fund via this online form. On Jan. 1, Mayor John Hamilton announced a proposal to increase the local income tax by 0.5% for Monroe County residents, raising about $16 million annually – half for the city, half for the county – to be used for economic development purposes. Hamilton proposed using the city's share for sustainability initiatives that have not yet been determined. The tax could be enacted if approved by the majority of the Bloomington City Council. |

Categories

Categories

All

Archives

Archives

May 2024

|

|

Copyright The Greater Bloomington Chamber of Commerce. All Rights Reserved.

RSS Feed

RSS Feed