The Chamber provides resources for navigating local issues. Looking for our elected officials directory? Click here.

Civic Engagement Resources

The Chamber supports strong civic engagement for a healthy community and business climate. This resource guide provides nonpartisan information for civic engagement in the Bloomington/Monroe County area.

Government Advisory Groups

Government Advisory Groups

The Chamber encourages our members to get involved with Bloomington and Monroe County citizen advisory boards and commissions. Volunteer boards and commissions give residents the opportunity to provide input on local policies that affect our city and county. There are over 45 city boards and commissions as well as over 40 county advisory groups. Click here for more information about City of Bloomington and Monroe County boards and commissions.

Elections

Elections

The Chamber supports the nonpartisan work of Monroe County Election Central, which is responsible for conducting elections in this area. This includes assisting with voter registration, recruiting poll workers, and publicizing information about the election process (voter locations, deadlines, etc.). The Chamber also provides opportunities to meet with local candidates through our Elect Connect forums.

There are no general elections in 2021.

There are no general elections in 2021.

Connect with state government

Connect with State Government

The Chamber is partnering with the League of Women Voters of Bloomington-Monroe County to help inform our members about the work of our state elected representatives. Click here for information about the 2021 forums.

Check out the Chamber's State Legislative Process guide for information about how the Indiana General Assembly works. During each legislative session, we also keep an updated bill tracker for legislation of interest to members.

Due to the pandemic, most of our typical events have been virtual in 2021. In 2020, the Chamber held our annual Legislative Preview Luncheon with a panel of state representatives on Friday, Jan. 17 at the Bloomington Country Club. In February of 2020, the Chamber hosted a Statehouse Drive-In with a catered lunch at the Indiana General Assembly Statehouse in Indianapolis as an opportunity to talk with our state representatives.

For a list of state legislators representing Bloomington/Monroe County, check out the Chamber's Elected Officials Directory.

Check out the Chamber's State Legislative Process guide for information about how the Indiana General Assembly works. During each legislative session, we also keep an updated bill tracker for legislation of interest to members.

Due to the pandemic, most of our typical events have been virtual in 2021. In 2020, the Chamber held our annual Legislative Preview Luncheon with a panel of state representatives on Friday, Jan. 17 at the Bloomington Country Club. In February of 2020, the Chamber hosted a Statehouse Drive-In with a catered lunch at the Indiana General Assembly Statehouse in Indianapolis as an opportunity to talk with our state representatives.

For a list of state legislators representing Bloomington/Monroe County, check out the Chamber's Elected Officials Directory.

Indiana Civic Health Alliance

Indiana Civic Health Alliance

The Chamber is a member of the Indiana Civic Health Alliance, a coalition to support more active nonpartisan civic engagement and to promote the recommendations of the 2019 Indiana Civic Health Index. The group supported two goals for 2020:

- Promote civic engagement by convening a civic education task force to study methods of instruction, programs, and educational outcomes to improve civic education opportunities for all ages and prepare policy recommendations to improve civic education opportunities and programs in Indiana.

- Increase voting turnout substantially in the 2020 elections, with the goal of moving Indiana from the Bottom 10 to the Top 10 of states in voter turnout.

Gender Wage Gap

addressing the gender wage gap: a how-to guide

Addressing The Gender Wage Gap: A How-To Guide

Indiana is a state full of business opportunities and fiscal stability. Yet, despite the increasing opportunities in our state, Indiana has consistently lagged in gender pay equality.

Multiple factors contribute to the inequitable pay for women, including long-held business processes and workplace biases. Closing the gap will require the recognition of these biases and implementation of multifaceted solutions in order to ensure the work Indiana women perform is valued fairly.

Presently, Indiana doesn’t have the skilled workforce necessary to fill all the current and new jobs coming to our state. Elevating women by closing the gender wage gap will strengthen our workforce by enhancing our ability to find and retain the talent we need to address Indiana’s tight labor market and further contribute to the growth of our state’s economy.

We urge all businesses to review the contents of this document, identify what specific actions they can take to close the gender wage gap and adopt policies to create a more fair and equitable pay environment. When everyone has the same incentives and opportunities, we all benefit from increased diversity, greater innovation and more financial stability for families which ultimately leads to a stronger economy.

Multiple factors contribute to the inequitable pay for women, including long-held business processes and workplace biases. Closing the gap will require the recognition of these biases and implementation of multifaceted solutions in order to ensure the work Indiana women perform is valued fairly.

Presently, Indiana doesn’t have the skilled workforce necessary to fill all the current and new jobs coming to our state. Elevating women by closing the gender wage gap will strengthen our workforce by enhancing our ability to find and retain the talent we need to address Indiana’s tight labor market and further contribute to the growth of our state’s economy.

We urge all businesses to review the contents of this document, identify what specific actions they can take to close the gender wage gap and adopt policies to create a more fair and equitable pay environment. When everyone has the same incentives and opportunities, we all benefit from increased diversity, greater innovation and more financial stability for families which ultimately leads to a stronger economy.

Why It Matters

The gender wage gap has existed since women entered the workforce. Indiana currently ranks 49th in the nation when it comes to gender pay equity—the result of a unique set of cultural norms and business practices and policies.

Any step we, as a state or business community, take will help to improve this standing which would have positive effects for Indiana’s economy. While the gender wage gap may seem daunting, the good news is you have control over how your company addresses that gap.

Putting policies and best practices in place to close the gender wage gap makes your company more attractive to potential employees by showing them you are committed to pay equality, increasing your applicant pool and chances of recruiting highly skilled workers. With over half of new college graduates being women, it is more important than ever to be an inclusive workplace.

The gender wage gap has existed since women entered the workforce. Indiana currently ranks 49th in the nation when it comes to gender pay equity—the result of a unique set of cultural norms and business practices and policies.

Any step we, as a state or business community, take will help to improve this standing which would have positive effects for Indiana’s economy. While the gender wage gap may seem daunting, the good news is you have control over how your company addresses that gap.

Putting policies and best practices in place to close the gender wage gap makes your company more attractive to potential employees by showing them you are committed to pay equality, increasing your applicant pool and chances of recruiting highly skilled workers. With over half of new college graduates being women, it is more important than ever to be an inclusive workplace.

Evaluation

EVALUATION

Closing your company’s gender wage gap starts with acknowledging the pay gap exists. Commit your company to do its part and begin by determining who in your organization is underpaid and how it happened.

What You Can Do Now

Conduct a landscape analysis of your company’s pay distribution by role, level and gender.

If you find pay inequality between employees at the same level, consider taking these steps:

What You Can Do Now

Conduct a landscape analysis of your company’s pay distribution by role, level and gender.

- Assemble a diverse team of men and women from different departments, and assign them the task of identifying what internal factors contribute to income inequality.

- Review your company’s workforce by position, salaries, job level and gender, as well as other forms of compensation such as benefits, bonuses and overtime.

If you find pay inequality between employees at the same level, consider taking these steps:

- Publish salary information for the various roles and levels within your organization. This kind of transparency will engender trust and loyalty from employees by showing your company wants to compensate everyone fairly.

- Raise the compensation of the underpaid employees to equalize pay.

- Implement automatic “bump-up pay,” meaning when you hire someone for a higher salary than their team members, those team members proactively receive an off-cycle increase in pay.

Education

EDUCATION

Having a diverse staff can improve your bottom line. Diverse groups are better and faster at problem-solving and are more likely to be innovative. Additionally, companies with higher gender diversity are more likely to outpace their industry competitors in terms of financial returns.

What You Can Do Now

Provide unconscious bias training for all staff:

Provide specific training for those involved in the hiring process to address biases such as “shifting criteria,” “higher bar” and “extra scrutiny.”

What You Can Do Now

Provide unconscious bias training for all staff:

- This type of training highlights the unconscious biases we all carry about people’s identities, how to recognize those patterns of thought, and ways to not let these biases influence decision-making.

- Effects of training are often short-lived but can be useful in decreasing bias if done before hiring and promotion decisions are made, such as just before periodic reviews/evaluations are conducted.

- Be aware of “double bind,” where women are often less liked the more they are seen as competent, but men are more likable the more competent they appear.

Provide specific training for those involved in the hiring process to address biases such as “shifting criteria,” “higher bar” and “extra scrutiny.”

- Shifting criteria: when a man has A education and B experience, a woman has B education and A experience, people choose the man as more qualified based on education/experience. When the education and experience are reversed, the man is still chosen as more qualified.

- Higher bar: women are required to have more evidence of competence and success than men.

- Extra scrutiny: men and women seem hirable at the same rates, but women receive more statements doubting their abilities and experiences.

Recruitment

RECRUITMENT

Adapting your recruitment and hiring practices could help close the gender wage gap by ensuring new hires don’t start out at a deficit in pay compared to other employees.

What You Can Do Now

Practices To Adapt Over Time

What You Can Do Now

- Set company goals to hire and promote more women.

- Avoid asking for previous wage information during the hiring process.

- Previous employers may have underpaid your new recruits. By asking for and basing pay

on previous pay, the gender wage gap may be perpetuated.

- Previous employers may have underpaid your new recruits. By asking for and basing pay

- Set the pay range for jobs based on value added to the organization before the hiring process begins.

- List the pay range on the job description.

- Being upfront about what you are willing to pay takes the onus off applicants to bring up pay, which may perpetuate the gender wage gap for women applicants in the negotiation process.

- Consider conducting blind screening during the hiring process.

- Using a human resource management system or applicant tracking system that removes applicant names allows recruiters and hiring managers to do a first cut without accessing applicant identifying information reducing the likelihood of unintentional bias.

Practices To Adapt Over Time

- Do not rush the hiring process. Allow extra time in order to ensure enough applications from women candidates are received.

- If women aren’t applying for a particular position, ask why not and re-evaluate your recruiting process and resources.

- Research shows formal methods of recruitment result in a greater share of women in the workplace, as opposed to informal network-based recruitment.

- Remove gender bias from the job description with gender-friendly language. Jobs where women are hired are twice as likely to have contained growth-mindset language from the beginning.

- Limit salary negotiation for new hires.

- Men are often favored in negotiations due to cultural biases. Because of this, women may be more uneasy about the negotiation process and may fall into stereotypical feminine traps agreeing to lower pay and consequently continuing the cycle of gender pay discrimination.

- Have all personnel in a hiring position complete gender bias training and negotiation training before beginning the hiring process.

- Have some formalized method of determining offers if you do choose to continue negotiating.

retention

RETENTION

Retaining employees reduces the amount of resources spent on hiring, training and integrating new hires, while ensuring institutional knowledge is not lost. Retaining women employees ensures diversity among staff, and research has proven that companies with a diverse staff are more productive, more innovative and are overall more successful.

What You Can Do Now

Practices To Adapt Over Time

What You Can Do Now

- Company culture and values are set by leadership.

- Have company leadership publish a statement of intent to acknowledge and address

the gender wage gap.

- Have company leadership publish a statement of intent to acknowledge and address

- Set short-term, attainable goals for closing gaps and celebrate small wins.

- Simple small steps toward gender pay equality can build over time, creating new norms for businesses.

- Ensure transparency in how pay is set in the hiring and promotion process.

- Publishing pay for position levels within the company and the formula used to decide starting pay and promotions for different levels of positions can increase transparency between management and internal employees.

- Ask why employees are choosing to leave your company.

- Retention could be improved if policies are implemented based on feedback from employees about company culture, etc.

Practices To Adapt Over Time

- Put paid parental leave policy in place for all new parents.

- Having parental leave that is specific to mothers and fathers would lessen the difference in work missed between moms and dads, and could help change the perception of which parent is expected take a significant amount of time off work when a couple has a baby.

- Allow employees access to customizable, flexible schedules.

- This allows parents the time necessary to work around childcare schedules, maintain a full-time job, and stay on track for potential advancement.

- Implement return-to-work programs for those returning from parental leave.

- Empower managers to utilize return-to-work programs for staff retention.

- Return-to-work programs allow for gradual transitions back to work from parental leave and can help decrease the “motherhood penalty” for women.

- Be proactive and ask employees about their transition back into work and how their job will change before they go on leave.

- Many companies offer multiple flexible schedule and reduced-hour options over the course of parental leave time.

advancement

ADVANCEMENT

When looking at factors contributing to the gender wage gap, many note the lack of women in C-Suite and other top leadership positions. The following practices and policies will help decrease gender bias and ensure equal opportunity for advancement.

What You Can Do Now

Look at the distribution of men and women among projects and high-level responsibilities.

Practices To Adapt Over Time

What You Can Do Now

Look at the distribution of men and women among projects and high-level responsibilities.

- Check to see if women are afforded the same opportunities as men to show their skills and take on important projects.

- Watch for a disproportionate amount of less glamorous work being given to women. Employ a fair process for assigning these tasks and rotate them after a set time period.

Practices To Adapt Over Time

- Set goals (such as SMART goals) and achievement-based promotions for employees.

- The vast majority of companies already have this in place, but often they are gendered in construction. Conduct a re-evaluation of your performance measures to see if they reflect the traits of those already in power.

- Be specific. Ambiguity and overly-narrow definitions of success amplifies bias.

- Take advantage of mentoring programs for women, ensuring a pipeline of qualified women employees when leadership positions open up.

- Have your organization accept the Women’s Leadership Institute’s ElevateHER Challenge.

- The ElevateHER Challenge is a nonprescriptive, research based, action plan to help companies transform women’s leadership.

- The ElevateHER Challenge focuses on each of the following areas in order to reap the full benefit of enhancing women’s leadership:

- Increase the percentage of women in senior leadership positions.

- Increase the retention rate of women at all levels of your organization.

- Increase the number of women on your organization’s Board of Directors, extend the influence of women in your industry and encourage women to serve on community and corporate boards.

- Monitor pay by gender and close identified gaps.

- Establish a Leadership Development and/or Mentoring Program for women.

- Urge women to run for public office and give follow-up support.

Housing

This resource guide provides information about affordable/workforce housing initiatives in the Bloomington area.

city of bloomington

CITY OF BLOOMINGTON

Several units within the City of Bloomington are involved in affordable housing efforts, which are led by the administration of Mayor John Hamilton.

The city's Economic & Sustainable Development department handles issues related to developers, including tax abatements and payment-in-lieu-of-taxes (PILOT) options. The Planning & Transportation department oversees planning-related issues for housing. The Housing & Neighborhood Development (HAND) department provides grants and loans for affordable housing through the city's Housing Development Fund.

Click here for a list of the city's housing-related resources.

The city's Economic & Sustainable Development department handles issues related to developers, including tax abatements and payment-in-lieu-of-taxes (PILOT) options. The Planning & Transportation department oversees planning-related issues for housing. The Housing & Neighborhood Development (HAND) department provides grants and loans for affordable housing through the city's Housing Development Fund.

Click here for a list of the city's housing-related resources.

studies, reports, & Other resources

STUDIES, REPORTS & OTHER RESOURCES

Heading Home 2021: A Regional Plan for Making Homelessness Rare, Brief, and Non-Repeating (2021): A plan developed by the United Way of Monroe County, the Community Foundation of Bloomington & Monroe County, and the South Central Housing Network. This is intended serve as a community guide to support long-term initiatives in reducing and eliminating regional housing insecurity and homelessness in Monroe County.

Housing Webinar Series (2020-2021): A series of webinars on housing issues organized by the Regional Opportunity Initiatives.

Bloomington Housing Study (2020): A City of Bloomington study on housing needs.

Monroe County Housing Study (2019): Conducted by the Regional Opportunity Initiatives, as part of the 11-county Indiana Uplands Housing Study.

Bloomington Neighborhood Report (2019): Compilation of data from the Bloomington Board of Realtors.

Working Hard, Falling Behind – A Report on Affordability (2019): Compiled by the Bloomington Affordable Living Committee, this report includes a section on housing.

City of Bloomington Comprehensive Plan (2018): The city's long-range plan for land use and development. Chapter 5 focuses on housing and neighborhoods.

Community Housing Needs Assessment – Bloomington (2016): A report by the nonprofit South Central Indiana Housing Opportunities.

Monroe County Urbanizing Area Plan (2016): Phase II implementation report regarding design guidelines and zoning requirements for new development, redevelopment and property improvements.

City of Bloomington Housing & Neighborhood Development (HAND) Consolidated Plan 2015-2019) (2017): Report required by the U.S. Dept. of Housing & Urban Development (HUD) for communities that administer federal Community Development Block Grants (CDBG) and HOME Investment Partnership Program.

Housing Webinar Series (2020-2021): A series of webinars on housing issues organized by the Regional Opportunity Initiatives.

Bloomington Housing Study (2020): A City of Bloomington study on housing needs.

Monroe County Housing Study (2019): Conducted by the Regional Opportunity Initiatives, as part of the 11-county Indiana Uplands Housing Study.

Bloomington Neighborhood Report (2019): Compilation of data from the Bloomington Board of Realtors.

Working Hard, Falling Behind – A Report on Affordability (2019): Compiled by the Bloomington Affordable Living Committee, this report includes a section on housing.

City of Bloomington Comprehensive Plan (2018): The city's long-range plan for land use and development. Chapter 5 focuses on housing and neighborhoods.

Community Housing Needs Assessment – Bloomington (2016): A report by the nonprofit South Central Indiana Housing Opportunities.

Monroe County Urbanizing Area Plan (2016): Phase II implementation report regarding design guidelines and zoning requirements for new development, redevelopment and property improvements.

City of Bloomington Housing & Neighborhood Development (HAND) Consolidated Plan 2015-2019) (2017): Report required by the U.S. Dept. of Housing & Urban Development (HUD) for communities that administer federal Community Development Block Grants (CDBG) and HOME Investment Partnership Program.

governance/advisory groups

GOVERNANCE/ADVISORY GROUPS

- Bloomington Housing Authority Board: Oversees the BHA low-income public housing and the local Section 8 voucher program.

- Bloomington Plan Commission: The City of Bloomington's land use and development policy group, which has decision-making responsibilities for certain developments and acts as an advisory body for the City Council on zoning law and planned unit developments (PUDs). Works closely with the city planning & transportation department staff.

- Ellettsville Plan Commission: Makes recommendations on planning & development issues and projects. Works closely with the Departments of Planning & Street.

- Monroe County Affordable Housing Advisory Commission: Makes recommendations to the county regarding housing issues.

- Monroe County Plan Commission: An advisory body for the Monroe County Board of Commissioners, this group reviews development proposals and makes recommendations of approval or denial. Works closely with the Monroe County Planning Department staff.

housing-related organizations

Taxes

This guide provides resources for navigating the tax structure in Bloomington/Monroe County, Indiana. It is intended as a general overview to help you better understand how taxes are collected and spent. As you'll see, it's complicated.

If you're interested in a deeper dive, we recommend watching this presentation by Geoff McKim, an at-large Monroe County Councilor who is an expert in how our local tax system works.

If you're interested in a deeper dive, we recommend watching this presentation by Geoff McKim, an at-large Monroe County Councilor who is an expert in how our local tax system works.

local taxes: overview

Local Taxes: Overview

Revenue used to operate local government comes primarily from property taxes and income taxes. Other revenue sources include: fees and fines (such as stormwater fees, planning application fees, etc.), grants, transfers from the state (such as the gas tax), the innkeeper's tax, and the food & beverage tax.

These sources are restricted in two primary ways: 1) the amount that can be levied, and 2) the way in which particular tax revenue can be spent.

These sources are restricted in two primary ways: 1) the amount that can be levied, and 2) the way in which particular tax revenue can be spent.

Property Taxes

Property Taxes

If you own property in Monroe County, you will receive property tax bills that are due in May and November. It is calculated based on the value of your property and the tax rate that's levied by local taxing authorities, including Monroe County, municipalities (Bloomington, Ellettsville and Stinesville), townships, schools, library and special taxing districts, depending on where your property is located. Click here for a more detailed explanation on the Indiana Dept. of Local Government Finance site.

Local property tax rates are limited by the state in two ways: 1) the "frozen" levy (Assessed Value Growth Quotient), which prevents rates from increasing by more than a state-mandated amount each year, and 2) "circuit breakers" (tax caps), which prevent individual tax bills from exceeding a fixed percentage of assessed value each year.

Circuit breakers are defined in the state Constitution, and limit property taxes from exceeding the following percentage increases on assessed value:

Click here for the most recent local tax rates and a tax calculator to estimate your property tax bill.

Local property tax rates are limited by the state in two ways: 1) the "frozen" levy (Assessed Value Growth Quotient), which prevents rates from increasing by more than a state-mandated amount each year, and 2) "circuit breakers" (tax caps), which prevent individual tax bills from exceeding a fixed percentage of assessed value each year.

Circuit breakers are defined in the state Constitution, and limit property taxes from exceeding the following percentage increases on assessed value:

- 1% for owner-occupied homes (homesteads)

- 2% for agricultural land and other residential, including rental

- 3% for commercial and industrial properties

Click here for the most recent local tax rates and a tax calculator to estimate your property tax bill.

Local Income Tax (LIT)

Local Income Tax (LIT)

Monroe County currently levies a local income tax (LIT) of 1.345% on residents. This is in addition to the Indiana personal income tax of 3.23% and federal income tax.

The Monroe County Local Income Tax Council (LITC) is responsible for adopting the local income tax (LIT). It is comprised of four fiscal entities: the Bloomington City Council, the Ellettsville Town Council, the Monroe County Council, and the Stinesville Town Council. Voting shares for these entities are apportioned by population, so Bloomington City Council controls 58% of the LITC vote. (Note: The LITC is a "virtual" council, because it doesn't actually meet. Its votes are cast by the four fiscal entities.) Each of those fiscal bodies is authorized to allocate the portion of LIT revenues that each jurisdiction receives, based on population.

The state requires that the LIT is levied for one of four categories: 1) distributive shares (used for any lawful purpose), 2) public safety, 3) economic development, and 4) corrections. Currently, Monroe County only levies LIT for distributive shares and public safety.

The county's four fiscal entities also comprise the Public Safety LIT Committee (known as PS-LIT), which makes recommendations on setting the local income tax rate to fund public safety operations. Click here for a 2019 PS-LIT analysis report.

The Monroe County Local Income Tax Council (LITC) is responsible for adopting the local income tax (LIT). It is comprised of four fiscal entities: the Bloomington City Council, the Ellettsville Town Council, the Monroe County Council, and the Stinesville Town Council. Voting shares for these entities are apportioned by population, so Bloomington City Council controls 58% of the LITC vote. (Note: The LITC is a "virtual" council, because it doesn't actually meet. Its votes are cast by the four fiscal entities.) Each of those fiscal bodies is authorized to allocate the portion of LIT revenues that each jurisdiction receives, based on population.

The state requires that the LIT is levied for one of four categories: 1) distributive shares (used for any lawful purpose), 2) public safety, 3) economic development, and 4) corrections. Currently, Monroe County only levies LIT for distributive shares and public safety.

The county's four fiscal entities also comprise the Public Safety LIT Committee (known as PS-LIT), which makes recommendations on setting the local income tax rate to fund public safety operations. Click here for a 2019 PS-LIT analysis report.

Food & Beverage Tax

Food & Beverage Tax

The local Food & Beverage Tax is a 1% tax on food or beverage in Monroe County that's consumed at the location where it is purchased. The tax is collected at the point of purchase, primarily at restaurants.

The FAB tax revenues are divided between the City of Bloomington and Monroe County. Revenues are designated, by ordinance, for a convention center, conference center or related tourism or economic development projects. Click here to read the Dec. 12, 2017 ordinance passed by the Monroe County Council to enact the FAB tax. The bulk of the revenues will be used to fund the expansion of the Monroe Convention Center.

The FAB tax is overseen by the Monroe County Food & Beverage Tax Advisory Commission, which holds regular public meetings to vote on allocation requests from the city and county. Click here for the November 2019 FAB tax distribution report.

Click here for Monroe County's Business Guide to the FAB.

The FAB tax revenues are divided between the City of Bloomington and Monroe County. Revenues are designated, by ordinance, for a convention center, conference center or related tourism or economic development projects. Click here to read the Dec. 12, 2017 ordinance passed by the Monroe County Council to enact the FAB tax. The bulk of the revenues will be used to fund the expansion of the Monroe Convention Center.

The FAB tax is overseen by the Monroe County Food & Beverage Tax Advisory Commission, which holds regular public meetings to vote on allocation requests from the city and county. Click here for the November 2019 FAB tax distribution report.

Click here for Monroe County's Business Guide to the FAB.

Innkeeper's Tax

Innkeeper's Tax

Since 1977, Monroe County has levied an innkeeper's tax on accommodations and room rentals. The current tax is 5%. The tax revenues are used to operate the Monroe Convention Center and the Monroe County Convention & Tourism Bureau (Visit Bloomington). The Convention & Visitors Commission on Monroe County oversees the funds.

Transportation

This resource guide gives information on the area's major transit providers, other transportation options, parking, and links to transit-related governance/advisory groups.

Major Transit Providers

MAJOR TRANSIT PROVIDERS

BLOOMINGTON TRANSIT

Bloomington Transit is the main public transit operator in the City of Bloomington. Its primary hub is the transit center at the southeast corner of 3rd and Walnut. It also operates BTaccess, a service for people with disabilities.

INDIANA UNIVERSITY CAMPUS BUS

IU Campus Bus operates bus services within the university. It coordinates with Bloomington Transit – students, staff and faculty can ride BT buses at no cost by showing their Crimson Card.

RURAL TRANSIT

Rural Transit is a rural bus service that operates in Monroe County outside of Bloomington, as well as in the counties of Lawrence, Owen and Putnam. It is a unit of the Ellettsville-based Area 10 Agency on Aging.

Bloomington Transit is the main public transit operator in the City of Bloomington. Its primary hub is the transit center at the southeast corner of 3rd and Walnut. It also operates BTaccess, a service for people with disabilities.

INDIANA UNIVERSITY CAMPUS BUS

IU Campus Bus operates bus services within the university. It coordinates with Bloomington Transit – students, staff and faculty can ride BT buses at no cost by showing their Crimson Card.

RURAL TRANSIT

Rural Transit is a rural bus service that operates in Monroe County outside of Bloomington, as well as in the counties of Lawrence, Owen and Putnam. It is a unit of the Ellettsville-based Area 10 Agency on Aging.

Other Transportation Options

OTHER TRANSPORTATION OPTIONS

BIKING

The City of Bloomington maintains a Biking in Bloomington site, with a Bloomington/Monroe County bicycle map, bicycle registration info, and other useful resources. Monroe County's Alternative Transportation site provides Bike to Work Day Employer Packets, complaint forms for county cycling infrastructure, among other information. The Bloomington Bicycle Club is another resource for cycling in this area.

SCOOTERS

Two scooter companies operate in Bloomington: Bird and Lime. For information about how the City of Bloomington regulates scooters, click here.

ZIPCAR

The Zipcar car-sharing service primarily serves the IU campus. Click here for information on car locations and membership.

RIDE-SHARING

The Bloomington IN Rideshare Group on Facebook connects people who want to share long-distance rides, often to Indianapolis. Indiana University offers carpool and vanpool programs. People with IU affiliations also have access to Zimride, a private ride-sharing network.

RENTAL CARS

Most major rental car businesses operate in Bloomington, including Enterprise, Hertz, and Budget.

HOOSIER COMMUTER CLUB

IU offers a variety of incentives to reduce driving alone through the Hoosier Commuter Club, available to IU staff, faculty and students.

The City of Bloomington maintains a Biking in Bloomington site, with a Bloomington/Monroe County bicycle map, bicycle registration info, and other useful resources. Monroe County's Alternative Transportation site provides Bike to Work Day Employer Packets, complaint forms for county cycling infrastructure, among other information. The Bloomington Bicycle Club is another resource for cycling in this area.

SCOOTERS

Two scooter companies operate in Bloomington: Bird and Lime. For information about how the City of Bloomington regulates scooters, click here.

ZIPCAR

The Zipcar car-sharing service primarily serves the IU campus. Click here for information on car locations and membership.

RIDE-SHARING

The Bloomington IN Rideshare Group on Facebook connects people who want to share long-distance rides, often to Indianapolis. Indiana University offers carpool and vanpool programs. People with IU affiliations also have access to Zimride, a private ride-sharing network.

RENTAL CARS

Most major rental car businesses operate in Bloomington, including Enterprise, Hertz, and Budget.

HOOSIER COMMUTER CLUB

IU offers a variety of incentives to reduce driving alone through the Hoosier Commuter Club, available to IU staff, faculty and students.

Parking

PARKING

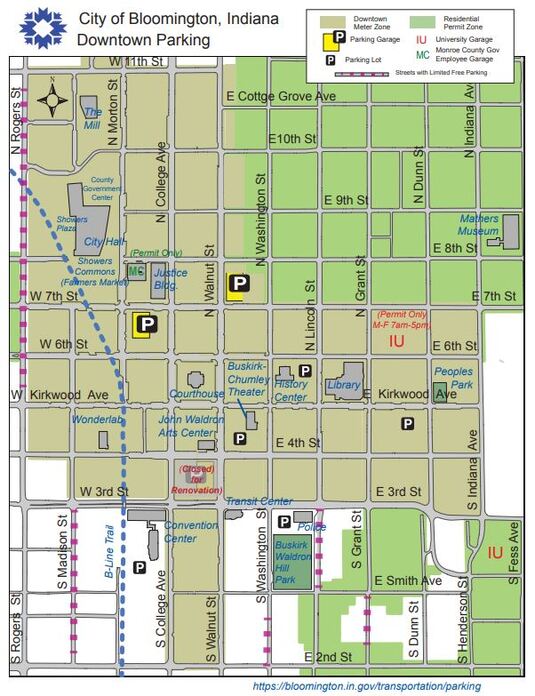

The City of Bloomington operates parking structures as well as metered parking lots and on-street parking. Street parking costs 25 cents per 15 minutes and is enforced Monday-Saturday, 8 a.m. til 9 p.m.

The City of Bloomington's Downtown Parking website and Visit Bloomington's online parking guide provide detailed descriptions of downtown parking options, both metered and free.

The city's site also includes information about the following topics:

- Business parking permits

- Neighborhood parking permits

- Monthly garage parking permits

- Parking tickets

- Temporary parking permits for special events

- Contractor and all-zone service permits

- Permits for dumpsters, moving trucks and PODs

- Local parking studies

Information about parking on the Indiana University campus is available:

TRANSPORTATION DEMAND MANAGEMENT

TRANSPORTATION DEMAND MANAGEMENT

In 2020, the City of Bloomington adopted a Transportation Demand Management (TDM) plan.

TDM is a strategy to provide options and incentives that encourage the use of non-single occupancy vehicles. Those options include public transportation, ridesharing, and infrastructure for pedestrians and bicyclists. Click here for information on the TDM plan.

TDM is a strategy to provide options and incentives that encourage the use of non-single occupancy vehicles. Those options include public transportation, ridesharing, and infrastructure for pedestrians and bicyclists. Click here for information on the TDM plan.

GOVERNANCE & ADVISORY GROUPS

GOVERNANCE & ADVISORY GROUPS

NOTE: Starting in early 2020, these meetings are being held online due to the COVID-19 pandemic.

Bloomington Public Transportation Corporation Board: Oversees Bloomington Transit operations. Meets at 5:30 p.m. on the 3rd Tuesday of each month at BT headquarters, 130 W. Grimes.

Bloomington Bicycle & Pedestrian Safety Commission: Meets at 5:30 p.m. on the 2nd Monday of each month at city hall, 401 N. Morton.

Bloomington Parking Commission: Meets at 5:30 p.m. on the 4th Thursday of each month at city hall, 401 N. Morton.

Bloomington Traffic Commission: Meets at 4:30 p.m. on the 4th Wednesday of each month at city hall, 401 N. Morton.

Monroe County Traffic Commission: Meets at 1:30 p.m. on the 3rd Thursday of each month at the North Showers Building, 501 N. Morton.

Bloomington Public Transportation Corporation Board: Oversees Bloomington Transit operations. Meets at 5:30 p.m. on the 3rd Tuesday of each month at BT headquarters, 130 W. Grimes.

Bloomington Bicycle & Pedestrian Safety Commission: Meets at 5:30 p.m. on the 2nd Monday of each month at city hall, 401 N. Morton.

Bloomington Parking Commission: Meets at 5:30 p.m. on the 4th Thursday of each month at city hall, 401 N. Morton.

Bloomington Traffic Commission: Meets at 4:30 p.m. on the 4th Wednesday of each month at city hall, 401 N. Morton.

Monroe County Traffic Commission: Meets at 1:30 p.m. on the 3rd Thursday of each month at the North Showers Building, 501 N. Morton.

Understanding the Indiana Legislative Process

Navigating the indiana general assembly

Navigating the Indiana General Assembly

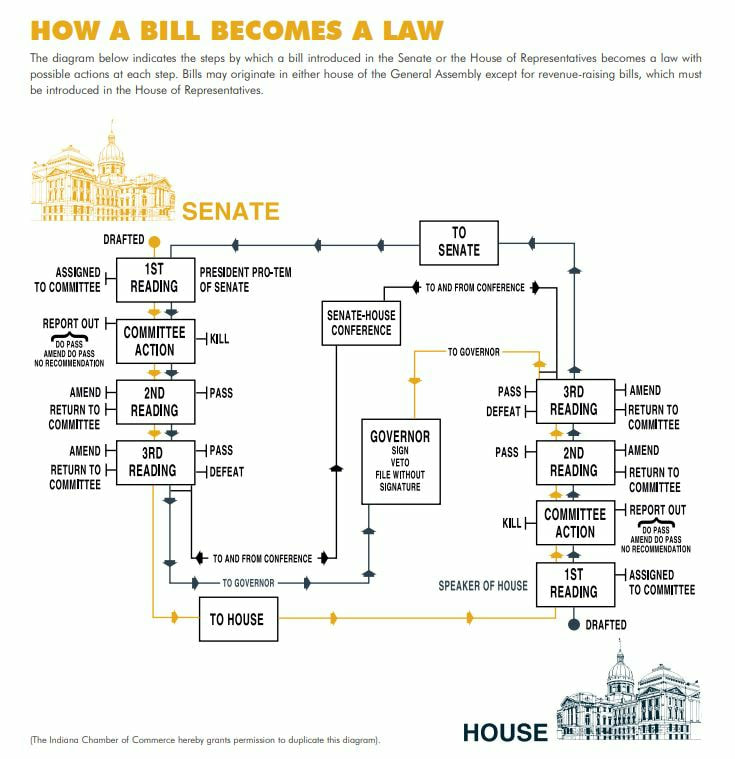

Understanding how the state legislature works can be a daunting challenge. This site provides a general overview of the process. For a detailed description of the Indiana legislative process, watch this League of Women Voters' forum featuring Rep. Matt Pierce: "How the State Legislature Really Works: What You Didn't Learn in Civics Class."

Additional information, including the current legislative schedule and list of bills, is on the Indiana General Assembly website.

Additional information, including the current legislative schedule and list of bills, is on the Indiana General Assembly website.

Steps in the indiana Legislative process

Steps in the Indiana Legislative Process

1. First Reading: A first reading is the time when a bill is introduced in the House of Representatives or Senate (the “house of origin”). The bill’s title is read aloud by the clerk, who hands it to the presiding officer – the House Speaker or Senate President Pro Tem – for assignment to one of the standing committees in the “house of origin” (House or Senate).

2. In Committee: Committees can hold great power, because the Committee Chair decides which of the bills that have been assigned to the Committee will be considered. Committee hearings for individual bills are open to the public. If the Committee decides that a bill should move forward, they recommend "Do Pass" and send it on for a second reading.

3. Second Reading: After a bill is reported “do pass” by the Committee, it is reprinted. A copy must be on every legislator's desk 24 hours to be eligible for a second reading. While up for second reading, a bill can be amended by a majority vote of Committee members in favor of the amendment. If the bill survives second reading, it is ready after another 24 hours for a third reading.

4. Third Reading: The bill now has arrived at a critical point. At third reading, it cannot be amended by less than a two-thirds vote. With no amendments, the bill is voted on as it stands and is either passed or rejected by a majority vote of Committee members.

5. Other Chamber: If the bill survives these steps in the house of origin, it is sent to the other chamber, where it must go through the same procedures of three readings and a committee hearing. That chamber may then pass the bill, amend it or kill it.

6. Amendments: If the other chamber amends the bill, it must go back to its house of origin for a vote. The house of origin may agree with the amendments made or it can reject those changes. If there are no amendments, the bill is signed by the Speaker of the House and the President of the Senate and sent to the Governor.

7. Conference Committee: If the house of origin won't accept the new amendments, the bill goes to a two-house committee that draws up a single compromise bill. The compromise bill then goes back to both the House and Senate for another vote. If both chambers pass the amended version, it is signed by the Speaker of the House and by the President of the Senate. It then goes to the Governor.

8. To the Governor: If the Governor signs the bill, it becomes a law. If the Governor vetoes the bill, it can only become a law if both the House and Senate override the veto by a majority vote in each house. The Governor can let the bill become a law by taking no action at all for seven days, at which point it becomes law.

2. In Committee: Committees can hold great power, because the Committee Chair decides which of the bills that have been assigned to the Committee will be considered. Committee hearings for individual bills are open to the public. If the Committee decides that a bill should move forward, they recommend "Do Pass" and send it on for a second reading.

3. Second Reading: After a bill is reported “do pass” by the Committee, it is reprinted. A copy must be on every legislator's desk 24 hours to be eligible for a second reading. While up for second reading, a bill can be amended by a majority vote of Committee members in favor of the amendment. If the bill survives second reading, it is ready after another 24 hours for a third reading.

4. Third Reading: The bill now has arrived at a critical point. At third reading, it cannot be amended by less than a two-thirds vote. With no amendments, the bill is voted on as it stands and is either passed or rejected by a majority vote of Committee members.

5. Other Chamber: If the bill survives these steps in the house of origin, it is sent to the other chamber, where it must go through the same procedures of three readings and a committee hearing. That chamber may then pass the bill, amend it or kill it.

6. Amendments: If the other chamber amends the bill, it must go back to its house of origin for a vote. The house of origin may agree with the amendments made or it can reject those changes. If there are no amendments, the bill is signed by the Speaker of the House and the President of the Senate and sent to the Governor.

7. Conference Committee: If the house of origin won't accept the new amendments, the bill goes to a two-house committee that draws up a single compromise bill. The compromise bill then goes back to both the House and Senate for another vote. If both chambers pass the amended version, it is signed by the Speaker of the House and by the President of the Senate. It then goes to the Governor.

8. To the Governor: If the Governor signs the bill, it becomes a law. If the Governor vetoes the bill, it can only become a law if both the House and Senate override the veto by a majority vote in each house. The Governor can let the bill become a law by taking no action at all for seven days, at which point it becomes law.