The Indiana Chamber of Commerce recently released the results of its16th annual employer survey. Notably, 68% of respondents felt that Indiana is headed in the right direction. While still a challenge, the results of this survey indicate that workforce readiness and retention is trending in the right direction. The percentage of employers reporting that the supply of qualified applicants doesn't meet their needs has dropped from 72% in 2021 to 52% in 2023. While 67% of respondents reported leaving jobs open in the past year due to underqualified applicants, this has dropped from 74% in 2022. Nonetheless, 42% indicated that attracting and retaining workers remains their biggest challenge. Identifying the external factors negatively impacting talent attraction & retention, employers responded that childcare and housing were top issues. Despite this, only 13% reported either onsite childcare or an offsite partnership and only 7% reported some sort of childcare subsidy or reimbursement. The State Chamber pointed to a new $25 million Employer-Sponsored Childcare Fund and the adoption of policy recommendations by an interim study committee, but more time is needed to see whether business take advantage of this fund and whether the recommendations are adopted by the full legislature.

0 Comments

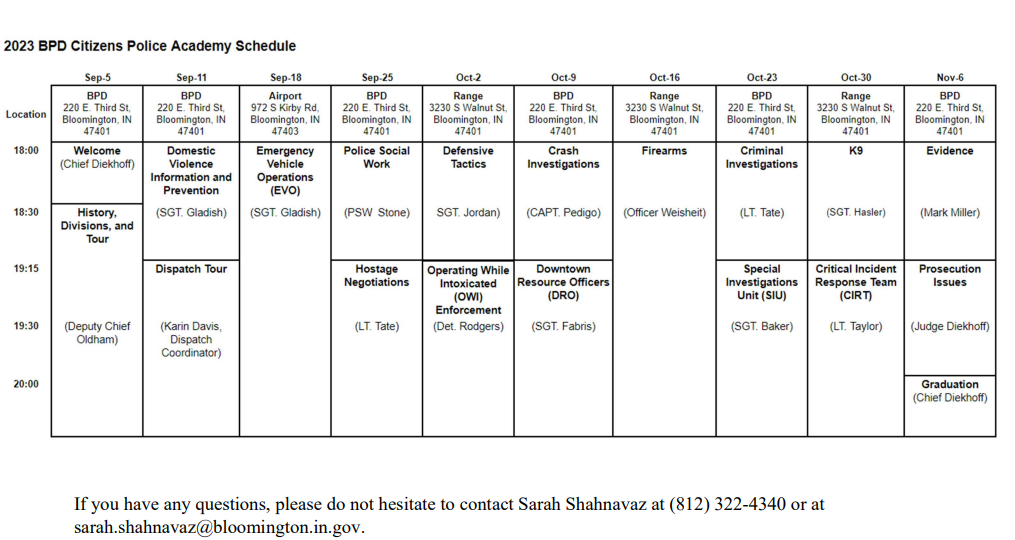

I took advantage of early voting at Election Central. My residency is in Bloomington District 5. Unfortunately there were no contested races on my ballot. Even the at-large council races have clear winners before election day. However, do not sleep on the MCCSC Referendum that allows every resident in the school district to make their voice heard. This referendum is coming only a year after MCCSC put forward a voter mechanism for pay increases in salary for both teachers and administrative staff members. Voters approved that measure by more than 2/3rds. This time around, funding goes toward pre-school and secondarily certification/credit fees students incumber. Listening to Monroe County Commissioners meeting this morning, Commissioner Githens indicated a 50 percent capacity issue with early-childhood care from a BEDC report. We were fortunate enough to have MCCSC Superintendent Dr. Jeff Hauswald at the Chamber's Advocacy Council who did an excellent job of explaining the need, the plan, and the cost. The debate has become muddled with a pair of Herald Times pieces HERE and HERE. However, talking with several key stakeholders in the early childhood education area, those pieces were misleading in some of their claims. The plan has been worked out to include both increases capacity and provide passthrough funds to Level 3 and 4 to families that meet the income requirements.  The Chamber is proud to have played a role in convening business leaders and service providers for a conversation regarding mental health, substance use disorder, and homelessness. This insightful conversation gave service providers the opportunity to discuss best practices and areas for growth while business leaders were able to highlight some of the serious concerns they have. We believe that creating a space for providers and the community to come together was important for a frank and honest discussion. As our President Eric Spoonmore alluded to, this issue is not unique to Bloomington. Our city, however, can distinguish itself in its response by working together to come up with compassionate and practical solutions. We look forward to further conversations followed by actions to achieve those ends. This event was chalk full of information and any one topic could be the subject of a dissertation. What caught my attention—particularly as it relates to the business community—was the talk about the need for people to stand by the side of those going through various crises to help them find the solid footing they need. One panelist mentioned the work Cook has done to provide second chance employment opportunities while also offering a wide range of services and resources to help people get the support they need. As the saying goes, “It takes a village”, and our business community can be part of that village. In conjunction with service providers, we should look at how we can work to lower barriers for employment for those with patchy work history or criminal records. We should look at how we can implement different programs and services to help people make the most of their second chances. One question from the audience asked how members of the community can make a difference even if it is by dedicating an hour of their day once a month. If our business community can help set up mentoring programs or a buddy system to help provide support for those in need, that can go a long way in making a difference. Relationships are the most important way to help people make it through tough times and a dedicated program to help foster these relationships can truly make a difference. I believe we can help be that village of support. The full recording of the event is avaible below and can also be found on CATS via this link. We asked our panelists some follow-up questions from audience members after the event. You can view their responses here.  One area the Chamber has regularly advocated for is the healthy, fully funded Bloomington Police Department (BPD). The city has been consistently understaffed from the 105 uniform officers that have been budgeted. The last figure I saw was 84 with an additional number of officers out for medical and military reasons pulling that figure down to under 80 working the streets. Having spoken about public safety during multiple public meetings, I felt as if I needed to know more. Sure, I have had discussions with rank-and-file officers but was that enough? Luckily, the Citizen’s Police Academy is back for a second year after a COVID hiatus. This will provide me with the necessary background and opportunities to ask questions about where I can be a better advocate. My background and interactions have not always been positive with law enforcement officials. Before moving to Bloomington, they could be deemed as “negative”. That had changed long before my role in the Chamber. There is a reason BPD is not involved in civil cases, writing large checks out in civil matters. We have a police force that is well-trained, courteous, and wanting to serve the public. When I go to the podium, I try to denote that my comments are not an endorsement of the culture and behaviors of the police but that of that of Bloomington. Nothing I say lessens or diminishes the sullied history of law enforcement in this country. The Chamber looks to the BPD as the model for the State and the country. Right now, I am four weeks into the program. I have learned a lot about what goes into policing in Bloomington. There is a reason the program is 10 Mondays, 2.5 hours per session. From hour one, they showed me and my cohort how they have worked to bring the culture to the force that represents the values of this community. I admit during Deputy Chief Oldham's presentation I welled up. They take public safety in this community seriously and that requires the right officers. Other areas such as learning about the difficulty in policing domestic violence, being in a police vehicle obstacle course, and how embedded social workers have been a model component for other departments around the state provided further proof. I hope to do a drive-along in all three shifts to get a first-hand look at what goes on behind the scenes. Below is the Academy Schedule  The Monroe County Community School Corporation is asking voters to approve a new referendum this fall. The election, held on November 7th, will seek voters' approval for an 8.5 cent (per $100 assessed evaluation) increase to the current 18.5 cent (per $100 assessed evaluation) referendum rate. While nominally 8.5 cents on the ballot, a combination of new state restrictions and projected property value growth in the county means the realized rate increase will be closer to 3.5 cents. Estimates suggest that the average cost to households would be about $50 with the referendum lasting 8 years. MCCSC is asking for this increase to support their "Family-Centered, Community Focused" initiative. Estimates from MCCSC suggest that quality preschool programs can cost up to $8000 a year--a barrier for many families. With only half of the 3- and 4-year-olds in the community currently in preschool programs, this two-pronged initiative aims to tackle barriers. This initiative will offer free or affordable Pre-K for all 3- and 4-year-olds in the community and will cover out-of-pocket costs for things like instructional materials, classroom supplies, student technology, AP exam fee, and CTE fees for K-12 students. Hello All,

My name is Josh Levesque and I am the new Advocacy Fellow here at the Chamber. I am a first-year graduate student at O'Neill working towards a Master of Public Affairs degree. I'm excited to be a part of this great team and organization for the next two years. As a bit of a local government nerd, it's been exciting to settle in these past few weeks and get a sense of the current events here in Bloomington. Prior to grad school, I worked in state and local government for a few years with a primary focus on constituent services and community engagement. During my time here at the Chamber, I'll work to support our advocacy team with research, policy recommendations, engagement, and government relations. I'll also be keeping a close eye on the great things happening in Ellettsville and providing periodic updates. Outside of school, I'm an avid soccer fan. I play in a couple of different leagues in Indianapolis and love to watch the Premier League on weekends (Go Arsenal!). I'm a bit of an old soul and have a real appreciation for blue and classic rock music. I live in Indianapolis with my partner and our cat. I'm deeply appreciative of the welcoming spirit of the community here and look forward to exploring Bloomington and coming across the many members the Chamber represents. Please don't hesitate to reach out to me at advocacy@chamberbloomington.org if I can be of any assistance.  Attempting to guide a ship when you are merely a passenger of good standing will always be an uphill climb. As someone heavily invested in the outcomes of our community, this has never stopped me. As expected, these outcomes rarely come out exactly the way I want. Recently, the City of Bloomington (COB), received an 8-0 recommendation from the Planning Commission for changes in the Unified Development Ordinance (UDO). This ordinance provides the roadmap for planning and development. The proposal was what the Chamber considered to be improvements that would allow certain processes to be streamlined including adding or increasing parking maximums. Four meetings and public comments later, the improvements we wanted were excised from the changes. Through perseverance, these positive outcomes are within the Chamber’s grasp. Often, a change in the environment can provide the necessary opening where all the hard work comes to fruition. Earlier in the month, the Chamber scored a pair of victories that were a long time in the making. First, the Monroe County Commissioners created a Capital Improvement Board (CIB). The entity will oversee the expansion and renovation of the Monroe County Center. The food & beverage tax was raised in 2017 to pay for this effort. Since then, there has been no shortage of strain between the COB and county on a framework to make this possible. Thanks to the tireless effort of the Chamber and its partners, we have been able to see the process through. The State has continually threatened to sunset the tax based on a lack of action from our elected officials. Our role was to dilute this language but there was only so long that strategy would work. Now we have seen four members appointed to the CIB, awaiting two more. Finally, expansion is in sight. The second development was a change in the city code that now allows Bloomington Transit (BT) to provide service outside the incorporated. This language has been in books for forty-one years. As a result, service to the Park 48 area including Cook Medical and Ivy Tech College was off limits for service, despite being a mere 1.3 miles away from the border. As a result, residents of Bloomington were unable to enhance their careers through employment and education opportunities. The Chamber has been pursuing this change since I started here five years ago. This included in a transit summit to address the disparity four years ago. By working with both the BT and the council transit champion, success has been achieved.  The City of Bloomington (COB) Common Council is on recess until July 26th. I thought it would be a good opportunity to assess where we are concerning specific issues. The long-delayed expansion to the Convention inches toward the finish line. As you recall, the County Council passed a food and beverage tax in 2017. Since then, we have had COVID, squabbling between the COB and County, yet little progress. The County Commissioners created a capital improvement board (CIB) back in late 2022, that saw widespread support from both county and city councils. However, it was contingent on the mayor’s support that never materialized. This time around, no such language exists as the commissioners will once again vote to create a CIB at their July 5th meeting. With the State adding pressure of a timeline, my belief is this gets done and we move forward with a CIB making the decisions free of politics. The Monroe County Community School Corporation (MCCSC) is moving forward with a referendum on the November 7th ballot. This will be asking residents to approve funds to support the district’s Family-Centered & Community Focus Initiative with early childhood education being the centerpiece. The ballot question includes a tax rate of 8.5 cents which equates to about $50 a year for a home appraised at 250k. This is a response to a lack of will by the State Assembly to properly support pre-K education, largely seen as one of the best investments a community can make. This comes after a successful 18.5-cent proposal by MCCSC in 2022. You can read the MCCSC news release HERE. Today will be the second outing for the county’s Justice Fiscal Advisory Committee (CFAC). This is a response to the commissioner’s decision to put the Criminal Justice Response Committee on hiatus. The county needs a new justice center. It has been well documented that the current jail facility is poorly designed and crumbling. The Council’s role here is fiscal, but will be looking at areas beyond a location. The Chamber had a member of CFAC at their last meeting, Councilmember Peter Iversen. He is one of three permanent voting members. The non-voting members will include all the key stakeholders including city representatives. The ambitious timeline includes having a full report completed by the end of September answering 6 questions: 1) Investments in Community Services where fewer people enter the system 2) Investments decrease recidivism rate 3) Equity in the justice system 4) Timeline to fund the investments 5) Revenue sources are available for capital portion including the newly passed by the state jail tax, bonding 6) revenue on annual basis for operating expenses Goal is to get this done with clear and concise recommendations. Last night I was honored to attend Hard Truth's ribbon cutting for it's new Rackhouse #2. Governor Holcomb was on hand to say a few words and enjoy a little bourbon.

As the municipal primary results are behind us, the summer slow season is upon us. Now is as good a time as any to clean out the advocacy notebook. The “trash talk” has commenced in the City of Bloomington (COB). Ordinance 23-11 will amend Title 6 of the Bloomington Municipal Code titled “Health and Sanitation”. This is a polite way to indicate the price of your trash collection will be going up. Residents may see a 58 to 75 percent increase in that cost. Currently, money from the general fund pays for the shortfall in fees. A subsidy is also required to fund the cost of curbside recycling. The current proposal attempts to ensure trash collection pays for itself and recycling. The debate will be heated as the fee increase represents sticker shock. This is coming after the large local income hike that went into effect last October. Council members will be required to be in attendance and not virtual to vote on this amendment. Based on staff recommendation, the COB Common Council will also take up updates to the Unified Development Ordinance (UDO). From a Chamber perspective, it adds parking maximums for various types of businesses. More importantly, it increases the maximums for restaurants and fitness centers. I spoke at the May 10th meeting. At least two of the council members pushed back on the proposed increase in parking. In the County, the Redevelopment Commission had a public meeting that provided an overview of a proposed housing TIF district along State Road 46 or the Criderville area. Bonds would be issued to pay for infrastructure (sewer, roads) for housing developments. The bond would be paid off through an increase in the assessed value of the property. The State Legislature this past session passed a law to make it easier for communities to put these districts together. Also in the county, the Criminal Justice Response Committee has been put on hiatus by the commissioners. The County council implemented a resolution creating the Justice Fiscal Advisory Committee. This adds individuals who were not included, such as a Bloomington representative. 15 members, 3 people on the committee, and 12 ad-hoc. 3 council and 1 commissioner including ex-inmates, judges, etc. They will meet every other week. The council has the purse strings and they are looking to use that authority to influence the new location of the justice center and the programs within to reduce the recidivism rate. In Ellettsville, the Town Council passed Ordinance 2023-05 Approving a Moratorium on "NEW" Construction and Development of Certain Structures in Commercial and Industrial Districts. This would be in affect until their UDO is passed which looks to occur sometime around October.  Kerry Thomson defeated her two Democrat opponents to gain the Democratic nomination for mayor. This all but assures a win in November with no GOP or an independent candidate having filed. The turnout was disappointing in that less than 8,000 voters made it to the polls Thanks to key endorsements from three former mayors and a large fundraising advantage, she coasted to victory. Her campaign has promised a more collaborative and transparent means of governing Bloomington which contrasts with the current administration. Kerry Thomson 43 percent Susan Sandberg 34 percent Don Griffin 23 percent The make-up of the nine-member city will look dramatically different thanks to redistricting, a pair of upsets, and two members opting not to run. There are six candidates chosen by districts and three at-large. Five new council members are expected to take office in January. District 3 is the only race with a GOP opponent, Brett Heinisch. The current council was often split in its approach to local government. The more cautious majority will now only be bringing back Councilmember Dave Rollo, who was unopposed in his District 4 re-election bid. The biggest upset of the night was Kate Rosenberger nail bitter victory over Council President Sue Sgambelluri. Incumbent Ron Smith lost his District 3 seat to Hopi Stosberg. At-Large Results Isak Asare 19.91% Andy Ruff 18.81% Matt Flaherty 17.69% (I) Lois Sabo-Skelto 13.54% Jonas Schrodt 12.69% Steve Volan 12.16% (I) Ryne Shadday 5.20% District Winners D1 Isabel Piedmont-Smith (I) D2 Kate Rosenbarger (I)) D3: Hopi Strosberg D4: Dave Rollo (I) D5: Shruti Rana D6: David Wolfe-Bender (under review) Council members who did not seek re-election: Susan Sandberg and Jim Sims (I) = incumbant |

Categories

Categories

All

Archives

Archives

April 2024

|

|

The Greater Bloomington Chamber of Commerce. All Rights Reserved.

421 W 6th Street, Suite A | Bloomington, IN 47404 Phone: (812)336-6381 | info@chamberbloomington.org | sitemap Office Hours: Monday-Thursday: 9:00am - 5:00pm Friday: 9:00am-3:00pm Trust Center There is a no refund policy for events. If you need to reassign your ticket to another person we will be happy to update our attendance list. Thank you. |

RSS Feed

RSS Feed